DOL WHD WH-347 2025 free printable template

Show details

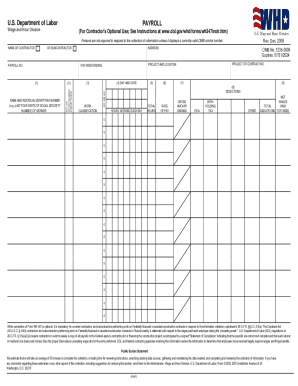

SUBMISSION OF FINAL DBRA CERTIFIED PAYROLL FORM PRIME CONTRACTOR Rev. January 2025 OMB No. 1235-0008 Expires 01/31/2028 SUBCONTRACTOR PROJECT NO. For Contractor s Optional Use See Instructions at www. dol*gov/whd/forms/wh347instr*htm Unless otherwise noted the information requested is speci c to the named project below. Persons are not required to respond to the collection of information unless it displays a currently valid OMB control number. or CONTRACT NO. CERTIFIED PAYROLL NO. PROJECT...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1968 whd wh payroll get form

Edit your 1968 labor wage form wh payroll fill form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1968 division 347 payroll blank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certified payroll report for prevailing wage online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fillable wh 347 forms. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DOL WHD WH-347 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fill out wh 347 form

How to fill out DoL WHD WH-347

01

Obtain the DoL WHD WH-347 form from the Department of Labor's website or other authorized sources.

02

Fill in the employer's information at the top, including the name, address, and contact details.

03

Provide the employee's information, including their name, address, and contact details.

04

Indicate the pay period for which the records are being submitted.

05

List the hours worked for each employee in the designated columns, including regular hours, overtime hours, and any deductions if applicable.

06

Include the rate of pay for each employee and calculate the total pay based on the hours worked.

07

Review the form for accuracy and ensure all required fields are completed.

08

Sign and date the form as required.

Who needs DoL WHD WH-347?

01

Employers who need to comply with the Fair Labor Standards Act (FLSA) wage and hour requirements.

02

Contractors and subcontractors working on federally funded projects.

03

Businesses wanting to document employee hours and payroll for compliance and auditing purposes.

Fill

347 instr forms

: Try Risk Free

People Also Ask about form wh347 fill

Can I print the DS-11 form in black and white?

Printing the DS-11 in black and white is just fine. Could it be printed in colour? Yes, both black and white and color printing are acceptable for passport application forms. How?

Where can I get a copy of form DS-11?

Where could I find a new passport form locally? The DS-11 New Passport application and any passport application form can be found at any post office or clerk of the court around the United States, and embassy around the world.

Can I print form DS 3053?

You can print it and fill it out by hand, or use the Passport Application Wizard to complete the form online and print it out to mail. You can also get a DS-82 form at a local passport acceptance facility or regional agency.

Can I print my own DS-11 form?

You can fill out the DS-11 form online or print out and fill out by hand. If you fill out the form electronically, at the end of the questionnaire you will need to print the form and bring it at the time of the interview.

Should I use DS-11 or DS 82?

Renewal Application (DS-82) You should complete this form if you meet our requirements to renew your passport. Keep in mind that children under age 16 cannot renew their passports and must apply using Form DS-11.

How do I download a PDF that is not downloadable?

2. How do I download a PDF that cannot be downloaded? If there is no download button when you open a PDF file on a browser, press Ctrl + P and then choose to print the file to PDF. In this way, you can save the file as PDF.

When I download a PDF on Iphone where does it go?

Your PDF opens and automatically saves in the Books app. You can find it later in the Library tab.

How do I download an office PDF?

If the file is unsaved, select File > Save As. Select Browse to choose the location on your computer where you want to save the file. In the drop-down list, select PDF. Select Save.

Where can I find the PDF I download?

Here is how to find downloads on your Android: Open your Android app drawer by swiping up from the bottom of the screen. Select My Files (or File Manager). Once you're in the My Files app, select Downloads. You can tap the Browse icon at the bottom of your screen to search for a PDF quickly.

How do I fill out a document sent by email?

0:40 3:00 How To Sign and Fill Out a PDF in Gmail - YouTube YouTube Start of suggested clip End of suggested clip And. If I want to sign something like down here I can use this drawing tool and draw a signatureMoreAnd. If I want to sign something like down here I can use this drawing tool and draw a signature like. So that's my real signature. Or you can use this sign tool. So it has zero save signatures.

How do I fill out a form that was emailed to me on Iphone?

0:25 1:34 how to fill out application sent by email on iphone - YouTube YouTube Start of suggested clip End of suggested clip It once you have done that you will go into mail. And from here you'll search for the applicationMoreIt once you have done that you will go into mail. And from here you'll search for the application form and once you have found the application. Form you will simply tap on open.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in whd form fillable without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your printable dol 4n form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my wh 347 pdf fillable in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your fillable whd certified payroll form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete blank wh347 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your wh 347 form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is DoL WHD WH-347?

The DoL WHD WH-347 is a document used by the U.S. Department of Labor's Wage and Hour Division for contractors and subcontractors to report wages paid to employees on federally funded projects.

Who is required to file DoL WHD WH-347?

Contractors and subcontractors performing work on federally funded projects are required to file the DoL WHD WH-347 as part of compliance with the Davis-Bacon Act or related labor laws.

How to fill out DoL WHD WH-347?

To fill out the DoL WHD WH-347, you need to provide information such as the employee's name, address, social security number, work classification, hours worked, rate of pay, and gross wages paid. The form must be signed and dated by the employer or an authorized representative.

What is the purpose of DoL WHD WH-347?

The purpose of the DoL WHD WH-347 is to document compliance with prevailing wage requirements and ensure that workers are paid correctly according to federal labor laws on government contracts.

What information must be reported on DoL WHD WH-347?

The DoL WHD WH-347 must report the employee's name, address, social security number, classification of work, number of hours worked each day, rate of pay, gross wages paid, deductions, and net pay.

Fill out your DOL WHD WH-347 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Davis Bacon Act Form is not the form you're looking for?Search for another form here.

Keywords relevant to davis bacon paperwork

Related to wage report form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.